How to Reset Income Tax Password with New Digital Signature Certificate

How to Reset Income Tax Password with New Digital Signature Certificate: Forgetting your Income Tax e-filing password is a very common issue. Many taxpayers panic because they cannot file returns, check notices, or respond to compliance. But the good news is—if you own a valid Class 3 Digital Signature Certificate (DSC), you can reset your password in just a few minutes.

I have personally helped clients reset their passwords using DSC, and in this guide, I’ll share both the official method and some practical tips that most users miss.

✅ What is a DSC and Why Do You Need It for Password Reset?

A Digital Signature Certificate (DSC) is like your digital identity for secure online transactions. It is legally recognized under the Information Technology Act, 2000, and mandatory for many government portals.

- For the Income Tax Portal, DSC ensures that the person requesting a password reset is the real PAN holder or authorized signatory.

- Unlike OTPs or Aadhaar, DSC offers a higher level of security for corporate and professional taxpayers.

👉 Important: Only a Class 3 DSC issued by a CCA (Controller of Certifying Authorities) authorized provider is valid. Examples of trusted providers:

- eMudhra

- Vsign

- PantaSign

- ProdigySign

- Capricorn CA

📌 You can verify the full list of licensed CAs here: CCA Licensed Certifying Authorities

Pre-Requisites Before You Start

To avoid errors during the reset process, make sure you have:

- A Valid DSC

- Check your DSC’s validity (expiry date).

- Ensure it matches the PAN of the taxpayer.

- USB Token & Drivers Installed

- Popular tokens: ProxKey, Watchdata, mToken, HYP2003.

- Download and install the correct driver for your token model. you can download from our download page.

- Embridge Signer Utility

- Download from the official Embridge website.

- Install and allow it to run in the background.

- Compatible Browser

- Use Google Chrome or Mozilla Firefox.

- Allow pop-ups and enable JavaScript.

⚠️ Tip from Experience: Many users face DSC errors because they never changed their default token password (123456 or 12345678). Always change it before using your DSC on government portals.

Step-by-Step Guide to Reset Income Tax Password with New DSC

Step 1: Visit the Income Tax Portal

- Open Income Tax e-Filing Portal.

- Click Login.

- Enter your User ID (PAN number) and click Continue.

Step 2: Select “Forgot Password”

- On the login page, click Forgot Password.

- Enter your PAN number again → Click Continue.

Step 3: Choose DSC as Recovery Option

- Select Upload Digital Signature Certificate.

- You’ll see two options:

- Registered DSC → If your DSC is already registered on the portal.

- New DSC → If this is a fresh DSC not yet linked.

(Tip: If you are unsure whether your DSC is registered, choose “New DSC.”)

Step 4: Verify Your DSC

- Tick the checkbox: “I have downloaded and installed Embridge Signer Utility.”

- Click Continue.

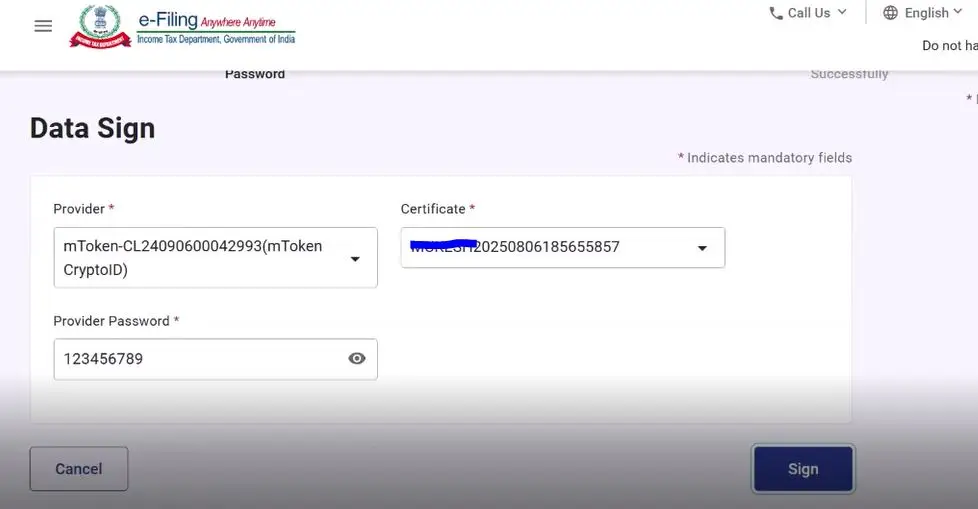

Step 5: Sign Using Your DSC

- Select Provider (USB Token Name)

- Example: ProxKey, Watchdata, mToken, HYP2003.

- Sometimes it may show a random serial number → Don’t panic, select it.

- Choose Your Certificate

- Example: If DSC is in the name of Rahul Sharma, it may appear as “Rahul Sharma” or a random code.

- It usually takes 5–9 seconds to appear. Be patient.

- Enter Token Password

- Avoid using default passwords.

- Example: Instead of

123456, set a custom password likeTax@2024.

- Click Sign and wait 5–10 seconds.

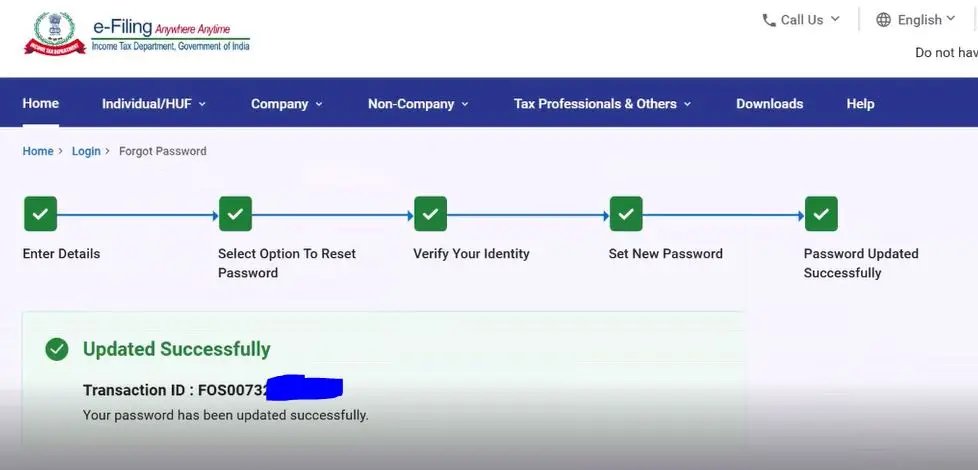

Step 6: Reset Your Password

Once your DSC is successfully verified:

- Enter a new password following the portal’s rules:

- Minimum 8 characters

- Must include: Uppercase, Lowercase, Number, Special Character

✅ Strong Example: IncomeTAX#2024

Now you can log in with your new password.

Common Issues & Troubleshooting

From real-world experience, here are the most common errors and fixes:

- DSC Not Detected → Check Embridge is installed and running.

- Invalid Certificate Error → Your DSC may be expired or not linked to PAN.

- USB Token Not Found → Install/update token drivers.

- Password Error → Reset default token password before use.

- Browser Freezing → Clear cache or try another browser.

Tips for Security & Best Practices

- Always renew your DSC before expiry to avoid login issues.

- Never share your USB token password with anyone.

- Keep a record of your Income Tax Portal password in a secure password manager.

- If you are a CA, company director, or legal signatory, ensure the DSC matches your registered role on the portal.

FAQs

Q1. Can I reset my Income Tax password without Aadhaar using DSC?

👉 Yes. DSC is a secure alternative to Aadhaar OTP for password reset.

Q2. Which DSC class is required for Income Tax Portal?

👉 A Class 3 DSC issued by a CCA-authorized Certifying Authority.

Q3. My DSC is expired. Can I still reset the password?

👉 No, you must renew your DSC first. Expired DSCs are invalid.

Q4. I entered my DSC password but it says “wrong password.” Why?

👉 Many tokens ship with default passwords like 123456. Change it first and then try.

Q5. Can I use DSC on mobile to reset my password?

👉 Currently, DSC reset works only on desktop/laptop with token drivers installed.

Conclusion

Resetting your Income Tax password with a new DSC is straightforward if you follow the steps carefully—install Embridge signer, connect your USB token, verify your DSC, and set a strong new password.

This method is especially useful for corporates, professionals, and taxpayers who rely on DSC instead of Aadhaar.

By ensuring your DSC is valid, drivers are installed, and token password is updated, you can avoid 90% of the common errors people face.

🔑 With this process, you can safely regain access to your Income Tax Portal and continue filing returns, responding to notices, or checking your tax status without delays.

Add comment