Digital Signature for Director eKYC: Complete 2025 Guide

Intoduction

Digital Signature for Director eKYC: Every year, thousands of company directors in India face a mandatory compliance requirement: Director eKYC. As per the Ministry of Corporate Affairs (MCA) regulations, this process ensures that every director’s personal details are verified and updated in the government’s database. While the task may seem daunting, the key to a smooth and penalty-free eKYC filing is a valid Digital Signature Certificate (DSC).

In this detailed guide, we’ll walk you through everything you need to know: what Director eKYC is, why a DSC is an essential component, how you can easily get one, and how to avoid heavy penalties.

What Exactly is Director eKYC?

Director eKYC (electronic Know Your Customer) is the process of verifying a company director’s identity and personal details with the MCA. This is done by filing the DIR-3 KYC form. It is a crucial annual exercise designed to keep the MCA’s database of directors accurate and up-to-date.

This process is mandatory for:

- All directors with a Director Identification Number (DIN): Whether you are an active director or not, if you hold a DIN, you must file.

- First-time filers: Directors who have been allotted a DIN and are filing their KYC for the first time must use the e-Form.

- Updating personal details: If you have changed your mobile number, email ID, or residential address, you must use the e-Form to update the details.

Failing to complete this process by the designated due date (typically September 30th) can lead to serious consequences. Your DIN will be marked as ‘Deactivated’, and you will have to pay a steep penalty of ₹5,000 to reactivate it. This deactivation can prevent you from signing any company documents or being appointed to a new directorship.

Why is a Digital Signature Certificate (DSC) Required for Director eKYC?

The Digital Signature Certificate is not just a convenience; it is a legal requirement. The MCA portal is a secure platform that handles sensitive legal and financial documents. To ensure the integrity and authenticity of every submission, it mandates that all forms, including the DIR-3 KYC, be digitally signed.

A valid DSC provides three key benefits:

- Secure Identity Authentication: A DSC is your secure digital identity. It proves that the person submitting the form is indeed the director whose details are being filed.

- Data Integrity: It ensures that the documents you are submitting have not been tampered with or altered after being signed. This is critical for maintaining the legal validity of your e-filing.

- Legal Validity: Under the Information Technology Act, 2000, a digital signature holds the same legal weight as a physical, handwritten signature.

Simply put, without a valid DSC, the MCA system will not accept your Director eKYC submission, putting your compliance at risk.

Understanding the Right Type of DSC: The Class 3 Advantage

When it comes to official government filings, not just any digital signature will do. The MCA and other government portals require a Class 3 DSC.

- Class 3 DSC (Signing): This is the highest level of DSC and is used for secure document signing. It offers the strongest security and verification, making it suitable for all high-value transactions and legal compliances, including MCA, GST, e-Tendering, and more.

A Class 3 DSC is typically issued with a validity of one or two years and is stored in a secure USB crypto token. This physical token, often from brands like Proxkey or mToken, protects your private key from unauthorized access.

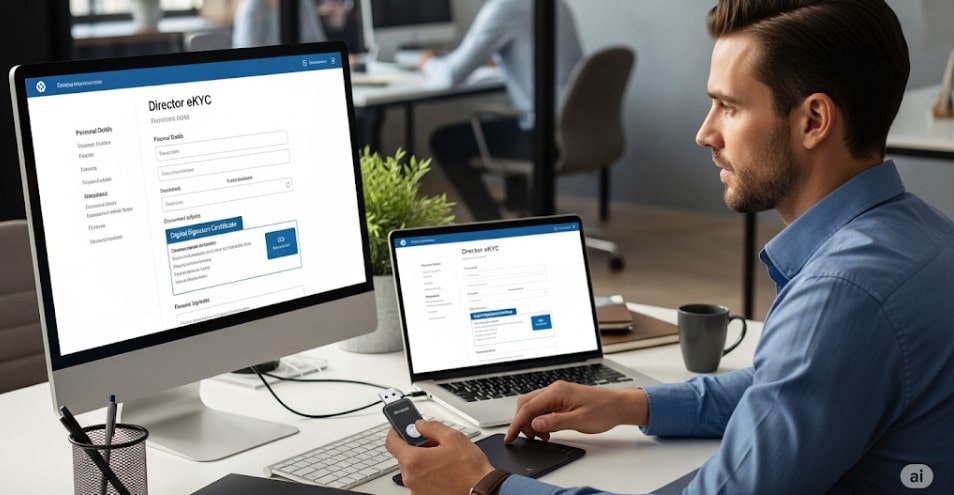

How to Get Your DSC for Director eKYC: A Simple, Step-by-Step Process

Obtaining a DSC has become a fully online and hassle-free process. Here is a simple guide to get you started:

- Choose a Licensed Certifying Authority: Digital signatures can only be issued by licensed Certifying Authorities (CAs) approved by the Controller of Certifying Authorities (CCA). Choosing a reputable provider ensures a smooth and compliant process.

- Fill out the Online Application: Complete the DSC application form with your basic details. This process is now largely paperless and can be done entirely online.

- Complete Aadhaar-based Verification: The fastest way to get your DSC is through Aadhaar-based verification. This involves a quick OTP verification on your Aadhaar-linked mobile number and a short video recording to confirm your identity.

- Receive Your DSC: Once your application is approved, your DSC is downloaded into a secure USB token, which is then dispatched to you.

The entire process, from application to approval, can often be completed in as little as 15-30 minutes with the right provider.

Cost of a DSC for Director eKYC

The price of a Class 3 DSC generally ranges from ₹1,200 to ₹2,000 (including GST) for a two-year validity. The final cost may vary slightly depending on the Certifying Authority and the type of USB token required (e.g., Proxkey, mToken, etc.).

Why Choose Our Service for Your Director DSC?

We understand the importance of a quick and reliable DSC for your compliance needs. Our service is designed to make the process as simple as possible.

- MCA-Approved Partner: We partner with MCA-registered Certifying Authorities, guaranteeing that your DSC will be valid for all your e-filing needs.

- 100% Online and Paperless: Our streamlined process eliminates the need for physical paperwork. Everything from application to verification is handled online.

- Fast Processing: With our efficient system, you can get your DSC approved on the same day, helping you meet tight deadlines.

- Expert Support: Our team provides free guidance not only for getting your DSC but also for completing your DIR-3 KYC filing, ensuring a smooth end-to-end experience.

FAQs About Director eKYC and DSCs

Q1: Can I use the same DSC for other purposes like GST or e-Tendering? A: Yes, a Class 3 DSC is a versatile tool. It is valid for MCA filings, GST returns, e-Tendering, income tax filings, and other government services, offering you great value.

Q2: Is Aadhaar mandatory for a DSC? A: Aadhaar-based eKYC is the fastest and easiest method, but it is not mandatory. You can also get a DSC using your PAN card and other identity and address proofs through an alternative verification process.

Q3: What if my DIN is already deactivated? A: You can still reactivate your DIN by filing the DIR-3 KYC form. However, you will need to pay the ₹5,000 penalty. Getting a DSC is the first step to starting this process.

Conclusion: Stay Compliant, Stay Ahead

Director eKYC is a non-negotiable annual compliance requirement. Having a valid Class 3 Digital Signature Certificate is the key to completing this process quickly, securely, and without incurring penalties.

Don’t let the compliance deadline catch you off guard. Get your MCA-approved DSC today and ensure your DIN remains active and your company stays compliant.

📞 Apply for your Director DSC today! 7579984381

Add comment